As a result, They might be considered an advance towards upcoming income as opposed to as a bank loan. They can also be simpler and quicker to obtain than regular business enterprise financial loans.

Overdrawing your checking account. In place of having a cash advance at an ATM, think about overdrawing your examining account with the debit card. You’ll encounter a rate, however you received’t have to worry about spending interest.

Redeeming the benefits you’ve earned can help you save funds on daily buys or assist in paying down your credit card harmony. Just be sure you’re not spending extra or going into financial debt to be able to get paid further rewards.

Explore much more cost savings accountsBest high-generate personal savings accountsBest personal savings accountsSavings account alternativesSavings calculator

The credit rating(s) you receive from us is probably not a similar scores used by lenders or other commercial buyers for credit selections. You will find many different types of credit scores, and lenders may well use a special style of credit score to make lending selections than those becoming available.

Some states make it possible for lenders to roll in excess of or renew loans When the borrower can not repay the loan plus expenses in complete.

In circumstances in which you have an unanticipated expenditure like A serious property or automobile mend or possibly a clinical Monthly bill, don’t underestimate the power of an honest dialogue with the business’s billing department.

To deliver you the listing of credit playing cards for negative credit, we use an goal ranking and ranking technique that compares attributes across a sizable list of credit playing cards (above two hundred of these from over 50 issuers).

A cash advance on a credit card can be a aspect which allows cardholders to withdraw cash, generally from an ATM or bank teller, using their credit card.

Although merchant cash advances are unsecured, you might be needed to signal a personal warranty, building you accountable for repayment even if you head out of company.

A. It depends upon your card’s cash advance limit, which will likely be a proportion within your whole credit Restrict. Look at using your issuer.

Beyond the possibility of taking over far too much financial debt and hurting your credit, you ought to attempt to avoid acquiring a cash advance as a result of substantial curiosity charges and fees.

You may obtain a cash advance at an ATM, the financial institution for your card or by producing a benefit check—also called click here an accessibility Check out—periodically mailed with the every month credit card assertion.

The desire rate on the cash advance will very likely be noticeably higher than your normal obtain APR (usually near thirty per cent variable). You can find also no grace interval for cash advance desire rates, so that you’ll begin accruing this inflated interest instantly.

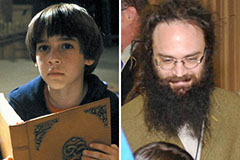

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!